Development#

Basics and Commonalities#

Before stepping into fitting development patterns, its worth reviewing the basics of Estimators. The main modeling API implemented by chainladder follows that of the scikit-learn estimator. An estimator is any object that learns from data.

Scikit-Learn API#

The scikit-learn API is a common modeling interface that is used to construct and

fit a countless variety of machine learning algorithms. The common interface

allows for very quick swapping between models with minimal code changes. The

chainladder package has adopted the interface to promote a standardized approach

to fitting reserving models.

All estimator objects can optionally be configured with parameters to uniquely specify the model being built. This is done ahead of pushing any data through the model.

estimator = Estimator(param1=1, param2=2)

All estimator objects expose a fit method that takes a Triangle as input, X:

estimator.fit(X=data)

All estimators include a sample_weight option to the fit method to specify

an exposure basis. If an exposure base is not applicable, then this argument is

ignored.

estimator.fit(X=data, sample_weight=weight)

All estimators either transform the input Triangle or predict an outcome.

Transformers#

All transformers include a transform method. The method is used to transform a

Triangle and it will always return a Triangle with added features based on the

specifics of the transformer.

transformed_data = estimator.transform(data)

Other than final IBNR models, chainladder estimators are transformers.

That is, they return your Triangle back to you with additional properties.

Transforming can be done at the time of fit.

# Fitting and Transforming

estimator.fit(data)

transformed_data = estimator.transform(data)

# One line equivalent

transformed_data = estimator.fit_transform(data)

assert isinstance(transformed_data, cl.Triangle)

Predictors#

All predictors include a predict method.

prediction = estimator.predict(new_data)

Predictors are intended to create new predictions. It is not uncommon to fit a model on a more aggregate view, say national level, of data and predict on a more granular triangle, state or provincial.

Parameter Types#

Estimator parameters: All the parameters of an estimator can be set when it is

instantiated or by modifying the corresponding attribute. These parameters

define how you’d like to fit an estimator and are chosen before the fitting

process. These are often referred to as hyperparameters in the context of

Machine Learning, and throughout these documents. Most of the hyperparameters

of the chainladder package take on sensible defaults.

estimator = Estimator(param1=1, param2=2)

assert estimator.param1 == 1

Estimated parameters: When data is fitted with an estimator, parameters are estimated from the data at hand. All the estimated parameters are attributes of the estimator object ending by an underscore. The use of the underscore is a key API design style of scikit-learn that allows for the quicker recognition of fitted parameters vs hyperparameters:

estimator.estimated_param_

In many cases the estimated parameters are themselves Triangles and can be

manipulated using the same methods we learned about in the Triangle class.

import chainladder as cl

import pandas as pd

import matplotlib.pyplot as plt

plt.style.use('ggplot')

%config InlineBackend.figure_format = 'retina'

dev = cl.Development().fit(cl.load_sample('ukmotor'))

type(dev.cdf_)

chainladder.core.triangle.Triangle

Commonalities#

All “Development Estimators” are transformers and reveal common a set of properties when they are fit.

ldf_represents the fitted age-to-age factors of the model.cdf_represents the fitted age-to-ultimate factors of the model.All “Development estimators” implement the

transformmethod.

cdf_ is nothing more than the cumulative representation of the ldf_ vectors.

dev = cl.Development().fit(cl.load_sample('raa'))

dev.ldf_.incr_to_cum() == dev.cdf_

True

Development#

Development allows for the selection of loss development patterns. Many

of the typical averaging techniques are available in this class: simple,

volume and regression through the origin. Additionally, Development

includes patterns to allow for fine-tuned exclusion of link-ratios from the LDF

calculation.

raa = cl.load_sample('raa')

cl.Development(average='simple')

Development(average='simple')In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook.

On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.

Development(average='simple')

Alternatively, you can provide a list to parameterize each development period

separately. When adjusting individual development periods the list must be

the same length as your triangles link_ratio development axis.

len(raa.link_ratio.development)

9

cl.Development(average=['volume']+['simple']*8)

Development(average=['volume', 'simple', 'simple', 'simple', 'simple', 'simple',

'simple', 'simple', 'simple'])In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook. On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.

Development(average=['volume', 'simple', 'simple', 'simple', 'simple', 'simple',

'simple', 'simple', 'simple'])This approach works for average, n_periods, drop_high and drop_low.

Notice where you have not specified a parameter, a sensible default is chosen for you.

Omitting link ratios#

There are several arguments for dropping individual cells from the triangle as well as excluding whole valuation periods or highs and lows. Any combination of the ‘drop’ arguments is permissible.

cl.Development(

drop_high=[True]*5+[False]*4,

drop_low=[True]*5+[False]*4).fit(raa)

Development(drop_high=[True, True, True, True, True, False, False, False,

False],

drop_low=[True, True, True, True, True, False, False, False, False])In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook. On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.

Development(drop_high=[True, True, True, True, True, False, False, False,

False],

drop_low=[True, True, True, True, True, False, False, False, False])cl.Development(drop_valuation='1985').fit(raa)

Development(drop_valuation='1985')In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook.

On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.

Development(drop_valuation='1985')

cl.Development(drop=[('1985', 12), ('1987', 24)]).fit(raa)

Development(drop=[('1985', 12), ('1987', 24)])In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook. On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.

Development(drop=[('1985', 12), ('1987', 24)])cl.Development(drop=('1985', 12), drop_valuation='1988').fit(raa)

Development(drop=('1985', 12), drop_valuation='1988')In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook. On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.

Development(drop=('1985', 12), drop_valuation='1988')When using drop, the earliest age of the link_ratio should be referenced.

For example, use 12 to drop the 12-24 ratio.

Note

drop_high and drop_low are ignored in cases where the number of link ratios available for a given development period is less than 1.

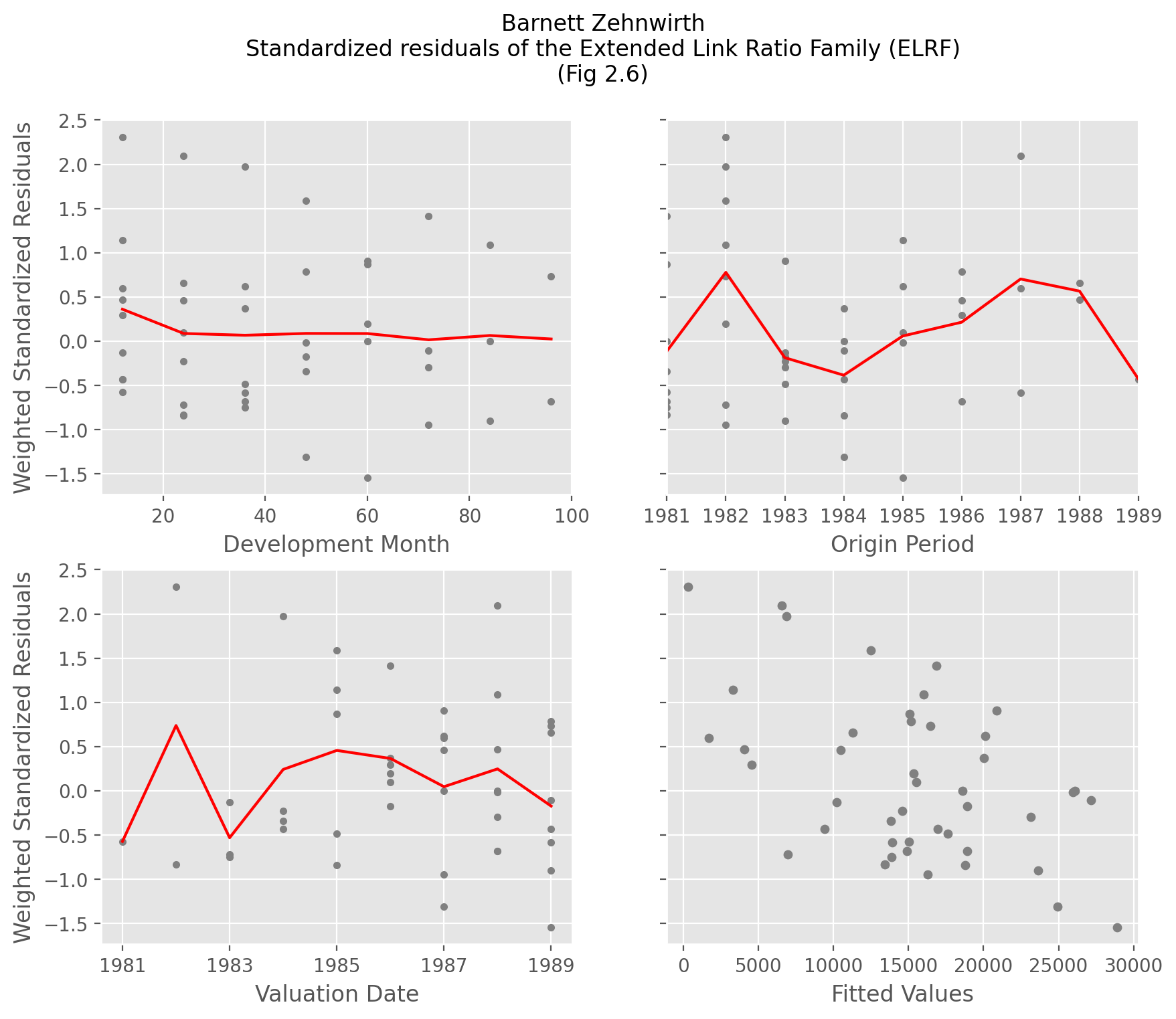

Extended Link Ratio Family#

The Development estimator is based on the regression framework known as the

Extended Link Ratio Family (ELRF). A nice property of this family is that we

not only get estimates for our patterns (cdf_, and ldf_), but also

measures of variability of our estimates (sigma_, std_err_ and std_residuals_

). These variability properties are used to develop the stochastic features in the

MackChainladder method, but even for deterministic methods these variability

estimates can be used as a diagnostic tool to validate the appropriateness of using

multiplicative link ratios.

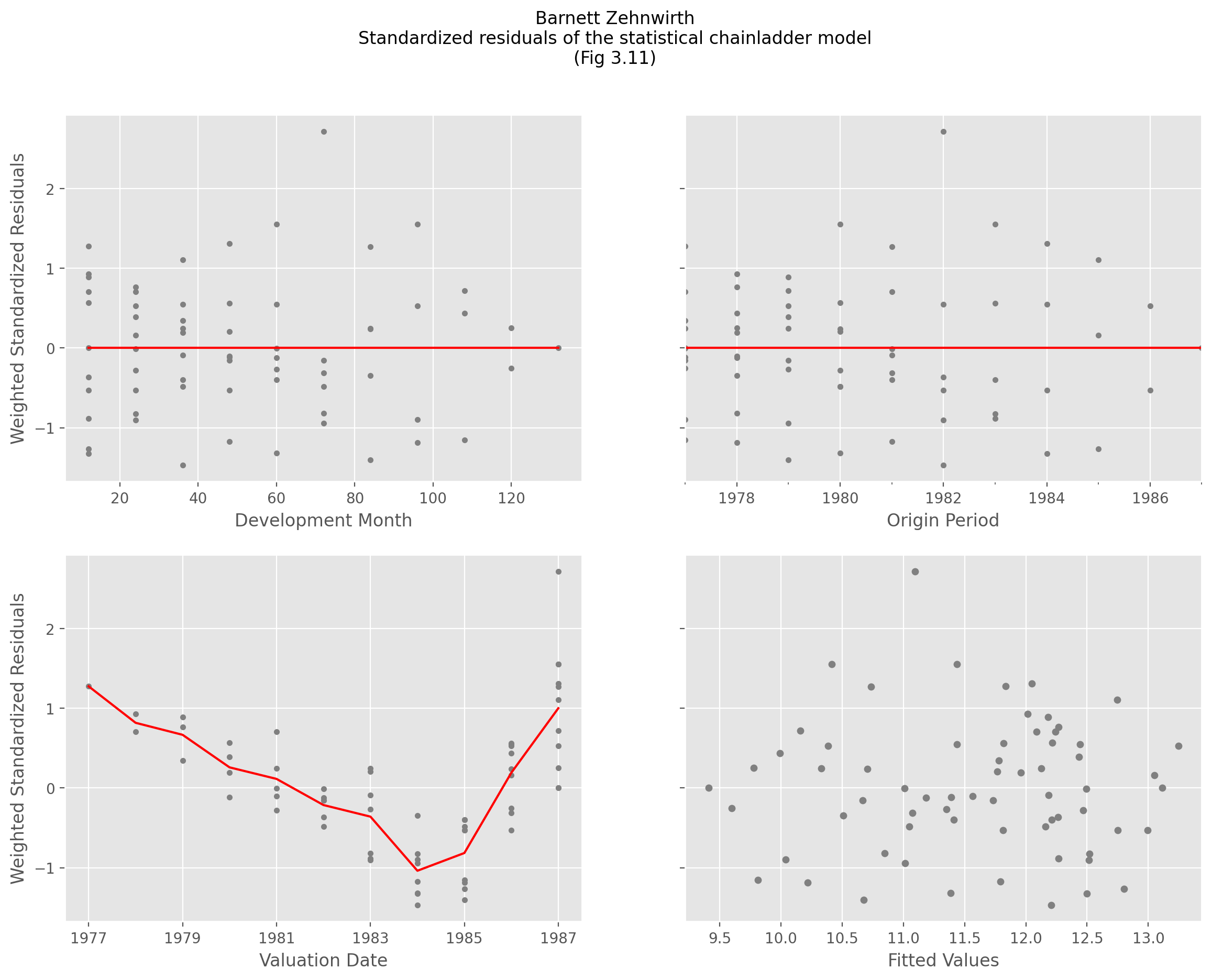

The std_residuals_ in particular is described by Barnett and Zehnwirth as a diagnostic

that points to the inferiority of the chainladder method relative to the probablistic

trend family.

raa = cl.load_sample('raa')

model = cl.Development().fit(raa)

model.std_residuals_

| 12 | 24 | 36 | 48 | 60 | 72 | 84 | 96 | 108 | |

|---|---|---|---|---|---|---|---|---|---|

| 1981 | -0.5722 | -0.8317 | -0.7489 | -0.3442 | 0.8704 | 1.4143 | -0.0003 | -0.6819 | |

| 1982 | 2.3075 | -0.7161 | 1.9716 | 1.5900 | 0.1982 | -0.9488 | 1.0919 | 0.7315 | |

| 1983 | -0.1267 | -0.2299 | -0.4811 | -0.1780 | 0.9056 | -0.2967 | -0.8987 | ||

| 1984 | -0.4305 | -0.8365 | 0.3723 | -1.3074 | 0.0012 | -0.1064 | |||

| 1985 | 1.1398 | 0.0943 | 0.6175 | -0.0170 | -1.5437 | ||||

| 1986 | 0.2936 | 0.4633 | -0.6809 | 0.7825 | |||||

| 1987 | 0.5961 | 2.0935 | -0.5805 | ||||||

| 1988 | 0.4717 | 0.6607 | |||||||

| 1989 | -0.4282 |

Replicating Fig 2.6 from their paper can be accomplished with a bit of manipulation of the residual triangles.

Show code cell source

fig, ((ax00, ax01), (ax10, ax11)) = plt.subplots(ncols=2, nrows=2, figsize=(10,8))

model.std_residuals_.T.plot(

style='.', color='gray', legend=False, grid=True, ax=ax00,

xlabel='Development Month', ylabel='Weighted Standardized Residuals')

model.std_residuals_.iloc[..., :-1].mean('origin').T.plot(

color='red', legend=False, grid=True, ax=ax00)

model.std_residuals_.plot(

style='.', color='gray', legend=False, grid=True, ax=ax01, xlabel='Origin Period')

model.std_residuals_.mean('development').plot(

color='red', legend=False, grid=True, ax=ax01)

model.std_residuals_.dev_to_val().T.plot(

style='.', color='gray', legend=False, grid=True, ax=ax10,

xlabel='Valuation Date', ylabel='Weighted Standardized Residuals')

model.std_residuals_.dev_to_val().mean('origin').T.plot(color='red', legend=False, grid=True, ax=ax10)

pd.concat((

(raa[raa.valuation<raa.valuation_date]*model.ldf_.values).unstack().rename('Fitted Values'),

model.std_residuals_.unstack().rename('Residual')), axis=1).dropna().plot(

kind='scatter', marker='o', color='gray', x='Fitted Values', y='Residual', ax=ax11, grid=True, sharey=True)

fig.suptitle("Barnett Zehnwirth\nStandardized residuals of the Extended Link Ratio Family (ELRF)\n(Fig 2.6)");

These residual plots which should should look random are used to highlight whether the chainladder model is violated. Violations generally occur due to trends in the valuation axis which are not accounted for in the basic chainladder method.

Transforming#

When transforming a Triangle, you will receive a copy of the original

triangle back along with the fitted properties of the Development

estimator. Where the original Triangle contains all link ratios, the transformed

version recognizes any ommissions you specify.

triangle = cl.load_sample('raa')

dev = cl.Development(drop=('1982', 12), drop_valuation='1988')

transformed_triangle = dev.fit_transform(triangle)

transformed_triangle.ldf_

| 12-24 | 24-36 | 36-48 | 48-60 | 60-72 | 72-84 | 84-96 | 96-108 | 108-120 | |

|---|---|---|---|---|---|---|---|---|---|

| (All) | 2.6625 | 1.5447 | 1.2975 | 1.1719 | 1.1134 | 1.0468 | 1.0294 | 1.0331 | 1.0092 |

transformed_triangle.link_ratio.heatmap()

| 12-24 | 24-36 | 36-48 | 48-60 | 60-72 | 72-84 | 84-96 | 96-108 | 108-120 | |

|---|---|---|---|---|---|---|---|---|---|

| 1981 | 1.6498 | 1.3190 | 1.0823 | 1.1469 | 1.1951 | 1.1130 | 1.0333 | 1.0092 | |

| 1982 | 1.2593 | 1.9766 | 1.2921 | 1.1318 | 0.9934 | 1.0331 | |||

| 1983 | 2.6370 | 1.5428 | 1.1635 | 1.1607 | 1.1857 | 1.0264 | |||

| 1984 | 2.0433 | 1.3644 | 1.3489 | 1.1015 | 1.0377 | ||||

| 1985 | 8.7592 | 1.6556 | 1.3999 | 1.0087 | |||||

| 1986 | 4.2597 | 1.8157 | 1.2255 | ||||||

| 1987 | 7.2172 | 1.1250 | |||||||

| 1988 | 1.8874 | ||||||||

| 1989 | 1.7220 |

By decoupling the fit and transform methods, we can apply our Development

estimator to new data. This is a common pattern of the scikit-learn API. In this

example we generate development patterns at an industry level and apply those

patterns to individual companies.

clrd = cl.load_sample('clrd')

clrd = clrd[clrd['LOB']=='wkcomp']['CumPaidLoss']

# Summarize Triangle to industry level to estimate patterns

dev = cl.Development().fit(clrd.sum())

# Apply Industry patterns to individual companies

dev.transform(clrd)

| Triangle Summary | |

|---|---|

| Valuation: | 1997-12 |

| Grain: | OYDY |

| Shape: | (132, 1, 10, 10) |

| Index: | [GRNAME, LOB] |

| Columns: | [CumPaidLoss] |

Groupby#

Triangles have a groupby method that follows pandas syntax and this allows for aggregating

triangle data to a more reasonable level for any particular analysis. However, it is often

the desire of an actuary to estimate development factors at a more aggregate grain generally

and then apply it to a more detailed triangle.

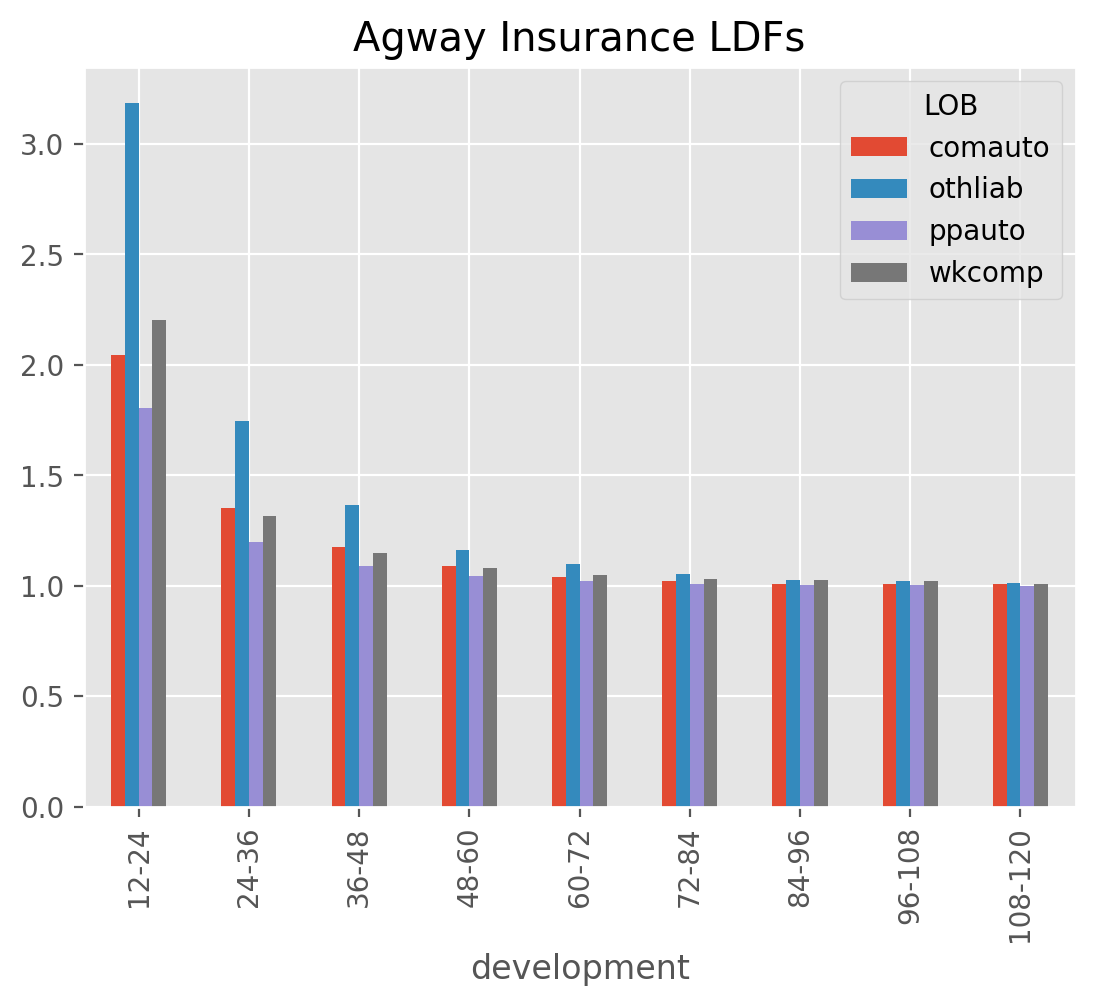

We can, for example, pick volume-weighted development patterns at a Line of Business level and subsequently apply them to each company within the line of business as follows:

clrd = cl.load_sample('clrd')['CumPaidLoss']

clrd = cl.Development(groupby='LOB').fit_transform(clrd)

clrd.shape, clrd.ldf_.shape

((775, 1, 10, 10), (6, 1, 1, 9))

Notice we’ve retained the grain of the original triangle, but there are six sets of development patterns, one for each line of business. Using this transformed triangle in an IBNR esimtator will result in IBNR at the original grain but using patterns at the Line of Business grain.

It is worth noting that fitting and transforming are entirely decoupled from one another, and we could achieve the same outcome by directly aggregating the Triangle before passing to the fit method.

clrd = cl.load_sample('clrd')['CumPaidLoss']

model = cl.Development().fit(clrd.groupby('LOB').sum())

clrd = model.transform(clrd)

clrd.shape, clrd.ldf_.shape

((775, 1, 10, 10), (6, 1, 1, 9))

This begs the question, why do we need a groupby hyperparameter as part of the Development estimator when we can aggregate the Triangle before fitting? In more advanced situations, we will be creating compound estimators called Pipelines which are very powerful for building custom workflows, but with the limitation that

fitting and transforming have to be coupled together. You can explore this in more detail in the

Pipeline section.

DevelopmentConstant#

The DevelopmentConstant estimator simply allows you to hard code development

patterns into a Development Estimator. A common example would be to include a

set of industry development patterns in your workflow that are not directly

estimated from any of your own data.

triangle = cl.load_sample('ukmotor')

patterns={12: 2, 24: 1.25, 36: 1.1, 48: 1.08, 60: 1.05, 72: 1.02}

cl.DevelopmentConstant(patterns=patterns, style='ldf').fit(triangle).ldf_

| 12-24 | 24-36 | 36-48 | 48-60 | 60-72 | 72-84 | |

|---|---|---|---|---|---|---|

| (All) | 2.0000 | 1.2500 | 1.1000 | 1.0800 | 1.0500 | 1.0200 |

By wrapping patterns in the DevelopmentConstant estimator, we can integrate

into a larger workflow with tail extrapolation and IBNR calculations.

Examples#

IncrementalAdditive#

The IncrementalAdditive method uses both the triangle of incremental

losses and the exposure vector for each accident year as a base. Incremental

additive ratios are computed by taking the ratio of incremental loss to the

exposure (which has been adjusted for the measurable effect of inflation), for

each accident year. This gives the amount of incremental loss in each year and

at each age expressed as a percentage of exposure, which we then use to square

the incremental triangle.

tri = cl.load_sample("ia_sample")

ia = cl.IncrementalAdditive().fit(

X=tri['loss'],

sample_weight=tri['exposure'].latest_diagonal)

ia.incremental_.round(0)

| 12 | 24 | 36 | 48 | 60 | 72 | |

|---|---|---|---|---|---|---|

| 2000 | 1,001.00 | 854.00 | 568.00 | 565.00 | 347.00 | 148.00 |

| 2001 | 1,113.00 | 990.00 | 671.00 | 648.00 | 422.00 | 164.00 |

| 2002 | 1,265.00 | 1,168.00 | 800.00 | 744.00 | 482.00 | 195.00 |

| 2003 | 1,490.00 | 1,383.00 | 1,007.00 | 849.00 | 543.00 | 220.00 |

| 2004 | 1,725.00 | 1,536.00 | 1,068.00 | 984.00 | 629.00 | 255.00 |

| 2005 | 1,889.00 | 1,811.00 | 1,256.00 | 1,157.00 | 740.00 | 300.00 |

These incremental_ values are then used to determine an implied set of

mutiplicative development patterns. Because incremental additive values are

unique for each origin, so too will be the ldf_.

ia.ldf_

| 12-24 | 24-36 | 36-48 | 48-60 | 60-72 | |

|---|---|---|---|---|---|

| 2000 | 1.8531 | 1.3062 | 1.2332 | 1.1161 | 1.0444 |

| 2001 | 1.8895 | 1.3191 | 1.2336 | 1.1233 | 1.0426 |

| 2002 | 1.9233 | 1.3288 | 1.2301 | 1.1212 | 1.0438 |

| 2003 | 1.9282 | 1.3505 | 1.2188 | 1.1148 | 1.0418 |

| 2004 | 1.8904 | 1.3276 | 1.2274 | 1.1184 | 1.0429 |

| 2005 | 1.9586 | 1.3395 | 1.2335 | 1.1210 | 1.0438 |

Incremental calculation#

The estimation of the incremental triangle can be done with varying hyperparameters

of n_period and average similar to the Development estimator. Additionally,

a trend in the origin period can also be selected.

Suppose there is a vector zeta_ that represents an estimate of the incremental

losses, X for a development period as a percentage of some exposure or sample_weight.

Using a ‘volume’ weighted estimate for all origin periods, we can manually estimate zeta_.

zeta_ = tri['loss'].cum_to_incr().sum('origin') / tri['exposure'].sum('origin')

zeta_

| 12 | 24 | 36 | 48 | 60 | 72 | |

|---|---|---|---|---|---|---|

| 2000 | 0.2432 | 0.2220 | 0.1540 | 0.1419 | 0.0907 | 0.0368 |

The zeta_ vector along with the sample_weight and optionally a trend

are used to propagate incremental losses to the lower half of the Triangle.

In the trivial case of no trend, we can estimate the incrementals for age 72.

zeta_.loc[..., 72] * tri['exposure'].latest_diagonal

| 72 | |

|---|---|

| 2000 | 148.00 |

| 2001 | 163.85 |

| 2002 | 195.43 |

| 2003 | 220.11 |

| 2004 | 255.15 |

| 2005 | 299.97 |

These are the same incrementals that the IncrementalAdditive method produces.

zeta_.loc[..., 72]*tri['exposure'].latest_diagonal == ia.incremental_.loc[..., 72]

True

Trending#

The IncrementalAdditive method supports trending through the trend

and the future_trend hyperparameters. The trend parameter is used in the

fitting of zeta_ and it trends all inner diagonals of the Triangle to its

latest_diagonal before estimating zeta_.

The future_trend hyperparameter is used to trend beyond the latest_diagonal

into the lower half of the Triangle. If no future trend is supplied, then

the future_trend is assumed to be that of the trend parameter.

cl.IncrementalAdditive(trend=0.02, future_trend=0.05).fit(

X=tri['loss'],

sample_weight=tri['exposure'].latest_diagonal

).incremental_.round(0)

| 12 | 24 | 36 | 48 | 60 | 72 | |

|---|---|---|---|---|---|---|

| 2000 | 1,001.00 | 854.00 | 568.00 | 565.00 | 347.00 | 148.00 |

| 2001 | 1,113.00 | 990.00 | 671.00 | 648.00 | 422.00 | 172.00 |

| 2002 | 1,265.00 | 1,168.00 | 800.00 | 744.00 | 511.00 | 215.00 |

| 2003 | 1,490.00 | 1,383.00 | 1,007.00 | 908.00 | 604.00 | 255.00 |

| 2004 | 1,725.00 | 1,536.00 | 1,151.00 | 1,105.00 | 735.00 | 310.00 |

| 2005 | 1,889.00 | 1,967.00 | 1,420.00 | 1,364.00 | 907.00 | 383.00 |

Note

These trend assumptions are applied to the incremental Triangle which produces drastically different answers from the same trends applied to a cumulative Triangle.

A nice property of this estimator is that it really only requires incremental amounts

so a Triangle that has cumulative data censored data in earlier diagonals can

leverage this method. Another nice property is that it allows for more explicit recognition

of future inflation in your estimate via the trend factor.

MunichAdjustment#

The MunichAdjustment is a bivariate adjustment to loss development factors.

There is a fundamental correlation between the paid and the case incurred data

of a triangle. The ratio of paid to incurred (P/I) has information that can

be used to simultaneously adjust the basic development factor selections for the

two separate triangles.

Depending on whether the momentary (P/I) ratio is below or above average,

one should use an above-average or below-average paid development factor and/or

a below-average or above-average incurred development factor. In doing so, the

model replaces a set of development patterns that would be used for all

origins with individualized development curves that reflect the unique levels

of (P/I) per origin period.

BerquistSherman Comparison#

This method is similar to the BerquistSherman approach in that it tries to

adjust for case reserve adequacy. However it is different in two distinct ways.

The

BerquistShermanmethod is a direct adjustment to the data whereas the MunichAdjustment keeps theTriangleintact and adjusts the development patterns.The MunichAdjustment is built in the context of a stochastic framework.

Residuals#

The MunichAdjustment uses the correlation between the residuals of the

univariate (basic) model and the (P/I) model. These correlations spin off a

property lambda_ which is represented by the line through the origin of

the correlation plots.

With the correlations, lambda_ known, the basic development patterns can

be adjusted based on the (P/I) ratio at any given cell of the Triangle.

Examples#

ClarkLDF#

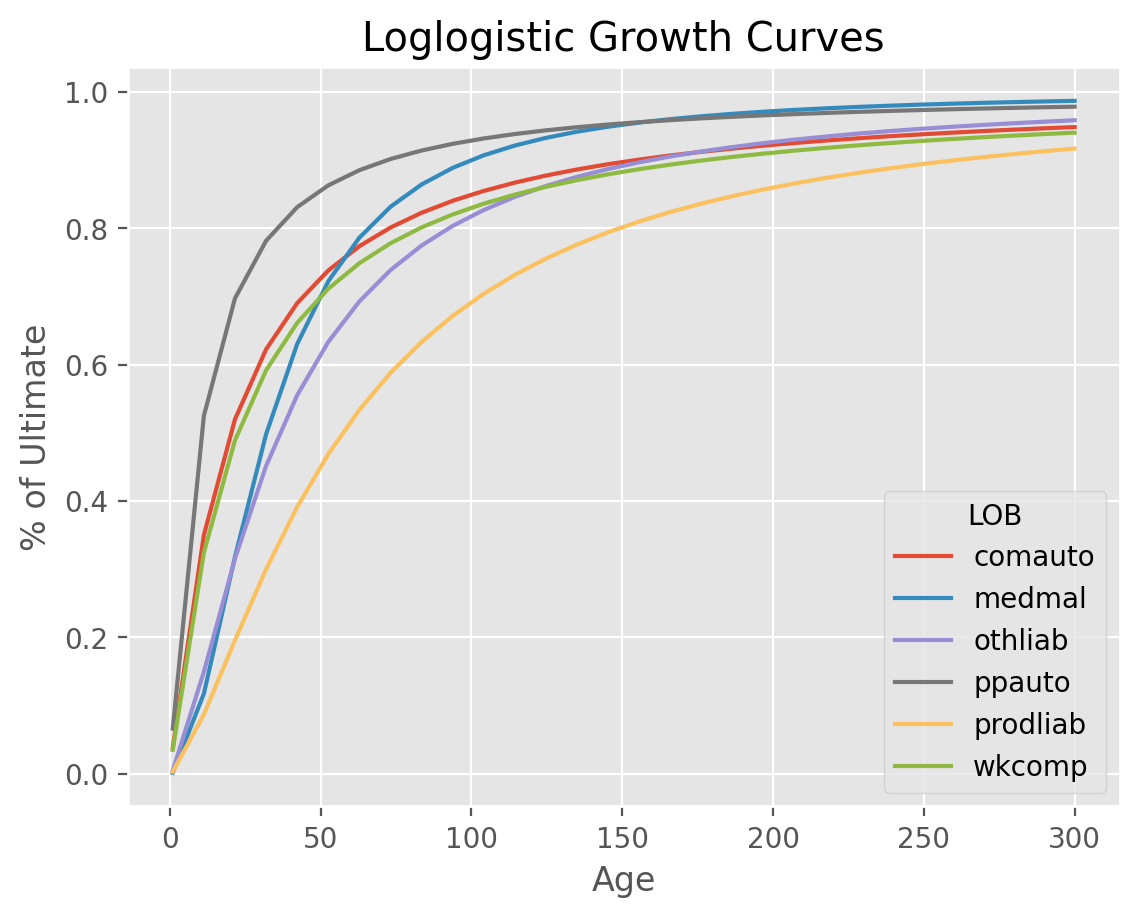

ClarkLDF estimates growth curves of the form ‘loglogistic’ or ‘weibull’

for the incremental loss development of a Triangle. These growth curves are

monotonic increasing and are more relevant for paid data. While the model can

be used for case incurred data, if there is too much “negative” development,

other Estimators should be used.

The Loglogistic Growth Function:

$G(x|\omega, \theta) =\frac{x^{\omega }}{x^{\omega } + \theta^{\omega }}$

The Weibull Growth Function:

$G(x|\omega, \theta) =1-exp(-\left (\frac{x}{\theta} \right )^\omega)$

Parameterized growth curves can produce patterns for any age and can even be used to estimate a tail beyond the latest age in a Triangle. In general, the loglogistic growth curve produces a larger tail than the weibull growth curve.

LDF and Cape Cod methods#

Clark approaches curve fitting with two different methods, an LDF approach and a Cape Cod approach. The LDF approach only requires a loss triangle whereas the Cape Cod approach would also need a premium vector. Choosing between the two methods occurs at the time you fit the estimator. When a premium vector is included, the Cape Cod method is invoked.

A simple example of using ClarkLDF LDF Method. Upon fitting the Estimator,

we obtain both omega_ and theta_.

clrd = cl.load_sample('clrd').groupby('LOB').sum()

dev = cl.ClarkLDF(growth='weibull').fit(clrd['CumPaidLoss'])

dev.omega_

| CumPaidLoss | |

|---|---|

| LOB | |

| comauto | 0.928929 |

| medmal | 1.569649 |

| othliab | 1.330082 |

| ppauto | 0.831529 |

| prodliab | 1.456171 |

| wkcomp | 0.898279 |

Perhaps more useful than the parameters is the growth curve G_ function they

represent which can be used to deetermine the development factor at any age.

1/dev.G_(37.5).to_frame()

LOB

comauto 1.270899

medmal 1.707238

othliab 1.619168

ppauto 1.118801

prodliab 2.126153

wkcomp 1.311587

dtype: float64

Another example showing the usage of the ClarkLDF Cape Cod approach. With

the Cape Cod, an Expected Loss Ratio is included as an extra feature in the elr_ property.

cl.ClarkLDF().fit(

X=clrd['CumPaidLoss'],

sample_weight=clrd['EarnedPremDIR'].latest_diagonal

).elr_

| CumPaidLoss | |

|---|---|

| LOB | |

| comauto | 0.680325 |

| medmal | 0.701443 |

| othliab | 0.623806 |

| ppauto | 0.825932 |

| prodliab | 0.671024 |

| wkcomp | 0.697930 |

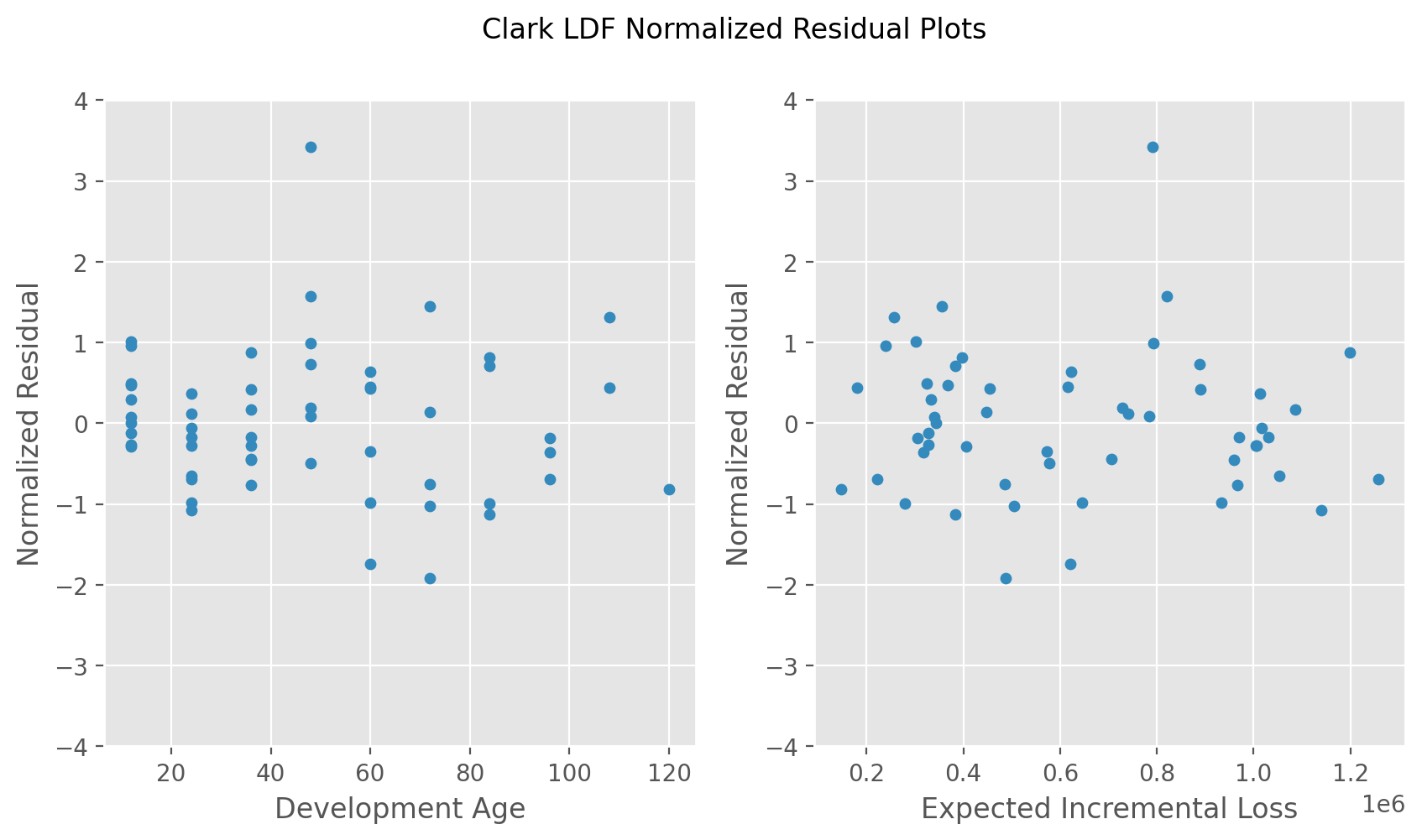

Residuals#

Clark’s model assumes Incremental losses are independent and identically distributed. To ensure compatibility with this assumption, he suggests reviewing the “Normalized Residuals” of the fitted incremental losses to ensure the assumption is not violated.

Stochastics#

Using MLE to solve for the growth curves, we can produce statistics about the parameter and process uncertainty of our model.

Examples#

CaseOutstanding#

The CaseOutstanding method is a deterministic method that estimates

incremental payment patterns from prior lag carried case reserves. Included

in this is also patterns for the carried case reserves based on the prior lag

carried case reserve.

Like the MunichAdjustment and BerquistSherman, this estimator

is useful when you want to incorporate information about case reserves into paid

ultimates.

To use it, a triangle with both paid and incurred amounts must be available.

tri = cl.load_sample('usauto')

model = cl.CaseOutstanding(paid_to_incurred=('paid', 'incurred')).fit(tri)

model.paid_ldf_

=== in _set_ldf ===

=== self.case ===

12 24 36 48 60 72 84 96 108 120

1998 1.798098e+07 9.602188e+06 5.414189e+06 2.867316e+06 1.405073e+06 722000.560555 397562.100227 251150.266276 169222.000000 98117.000000

1999 1.968226e+07 1.051070e+07 5.926455e+06 3.138608e+06 1.538014e+06 790312.901593 435177.580406 274912.938466 185233.000000 107400.375016

2000 2.181513e+07 1.164970e+07 6.568678e+06 3.478725e+06 1.704682e+06 875955.506899 482335.790378 304704.000000 205305.855545 119038.863909

2001 1.904741e+07 1.017168e+07 5.735298e+06 3.037373e+06 1.488406e+06 764821.490526 421141.000000 266045.667404 179258.340423 103936.193801

2002 1.956232e+07 1.044665e+07 5.890341e+06 3.119483e+06 1.528642e+06 785497.000000 432525.754277 273237.711280 184104.252262 106745.913175

2003 2.091944e+07 1.117138e+07 6.298978e+06 3.335894e+06 1.634690e+06 839990.148108 462531.839581 292193.331822 196876.319229 114151.314922

2004 2.007969e+07 1.072294e+07 6.046125e+06 3.201985e+06 1.569070e+06 806271.365800 443964.942762 280464.142653 188973.333980 109569.066729

2005 2.039616e+07 1.089194e+07 6.141416e+06 3.252450e+06 1.593800e+06 818978.706486 450962.107761 284884.432846 191951.671841 111295.943707

2006 2.066376e+07 1.103484e+07 6.221991e+06 3.295122e+06 1.614710e+06 829723.593216 456878.667897 288622.076985 194470.051080 112756.131011

2007 2.162359e+07 1.154741e+07 6.511004e+06 3.448181e+06 1.689714e+06 868264.503103 478100.819120 302028.659070 203503.243309 117993.687132

=== self.paid ===

12 24 36 48 60 72 84 96 108 120

1998 18539254.0 3.323104e+07 4.006201e+07 4.389204e+07 4.589654e+07 4.676542e+07 4.722132e+07 4.744688e+07 4.755546e+07 4.764419e+07

1999 20410193.0 3.609068e+07 4.325940e+07 4.715924e+07 4.920853e+07 5.016204e+07 5.062576e+07 5.087881e+07 5.100053e+07 5.109766e+07

2000 22120843.0 3.897601e+07 4.638928e+07 5.056238e+07 5.273528e+07 5.374010e+07 5.428433e+07 5.453322e+07 5.466649e+07 5.477415e+07

2001 22992259.0 4.009620e+07 4.776784e+07 5.209392e+07 5.436344e+07 5.537880e+07 5.587842e+07 5.611147e+07 5.622784e+07 5.632183e+07

2002 24092782.0 4.179531e+07 4.990380e+07 5.435288e+07 5.675438e+07 5.780722e+07 5.829581e+07 5.853516e+07 5.865467e+07 5.875120e+07

2003 24084451.0 4.139961e+07 4.907033e+07 5.358420e+07 5.593065e+07 5.697291e+07 5.749540e+07 5.775136e+07 5.787916e+07 5.798239e+07

2004 24369770.0 4.148986e+07 4.923668e+07 5.377467e+07 5.600590e+07 5.700632e+07 5.750783e+07 5.775352e+07 5.787618e+07 5.797527e+07

2005 25100697.0 4.270223e+07 5.064499e+07 5.499527e+07 5.726166e+07 5.827785e+07 5.878727e+07 5.903682e+07 5.916142e+07 5.926207e+07

2006 25608776.0 4.360650e+07 5.144103e+07 5.584838e+07 5.814450e+07 5.917403e+07 5.969013e+07 5.994296e+07 6.006919e+07 6.017116e+07

2007 27229969.0 4.545463e+07 5.365308e+07 5.826515e+07 6.066793e+07 6.174527e+07 6.228535e+07 6.254992e+07 6.268202e+07 6.278873e+07

=== set LDF return ===

Triangle Summary

Valuation: 2261-12

Grain: OYDY

Shape: (1, 2, 10, 9)

Index: [Total]

Columns: [incurred, paid]

| 24-36 | 36-48 | 48-60 | 60-72 | 72-84 | 84-96 | 96-108 | 108-120 | 120-132 | |

|---|---|---|---|---|---|---|---|---|---|

| (All) | 0.8428 | 0.7100 | 0.7084 | 0.6968 | 0.6376 | 0.6220 | 0.5534 | 0.4374 | 0.5243 |

In the example above, the incremental paid losses during the period 12-24 is expected to be

84.28% of the outstanding case reserve at lag 12. The set of patterns produced by

CaseOutstanding don’t follow the multiplicative approach commonly used in the

various IBNR methods making them not directly usable. Because of this, the estimator

determines the ‘implied’ multiplicative pattern so that a broader set of IBNR

methods can be used. Due to the origin period specifics on case reserves, each

origin gets its own set of multiplicative ldf_ patterns.

model.ldf_['paid']

| 12-24 | 24-36 | 36-48 | 48-60 | 60-72 | 72-84 | 84-96 | 96-108 | 108-120 | |

|---|---|---|---|---|---|---|---|---|---|

| 1998 | 1.7925 | 1.2056 | 1.0956 | 1.0457 | 1.0189 | 1.0097 | 1.0048 | 1.0023 | 1.0019 |

| 1999 | 1.7683 | 1.1986 | 1.0902 | 1.0435 | 1.0194 | 1.0092 | 1.0050 | 1.0024 | 1.0019 |

| 2000 | 1.7620 | 1.1902 | 1.0900 | 1.0430 | 1.0191 | 1.0101 | 1.0046 | 1.0024 | 1.0020 |

| 2001 | 1.7439 | 1.1913 | 1.0906 | 1.0436 | 1.0187 | 1.0090 | 1.0042 | 1.0021 | 1.0017 |

| 2002 | 1.7348 | 1.1940 | 1.0892 | 1.0442 | 1.0186 | 1.0085 | 1.0041 | 1.0020 | 1.0016 |

| 2003 | 1.7189 | 1.1853 | 1.0920 | 1.0438 | 1.0186 | 1.0092 | 1.0045 | 1.0022 | 1.0018 |

| 2004 | 1.7025 | 1.1867 | 1.0922 | 1.0415 | 1.0179 | 1.0088 | 1.0043 | 1.0021 | 1.0017 |

| 2005 | 1.7012 | 1.1860 | 1.0859 | 1.0412 | 1.0177 | 1.0087 | 1.0042 | 1.0021 | 1.0017 |

| 2006 | 1.7028 | 1.1797 | 1.0857 | 1.0411 | 1.0177 | 1.0087 | 1.0042 | 1.0021 | 1.0017 |

| 2007 | 1.6693 | 1.1804 | 1.0860 | 1.0412 | 1.0178 | 1.0087 | 1.0042 | 1.0021 | 1.0017 |

Incremental patterns#

The incremental patterns of the CaseOutstanding method are avilable as

additional properties for review. They are the paid_to_prior_case_ and the

case_to_prior_case_. These are useful to review when deciding on the appropriate

hyperparameters for paid_n_periods and case_n_periods. Once you are satisfied

with your hyperparameter tuning, you can see the fitted selections in the

paid_ldf_ and case_ldf_ incremental patterns.

model.case_to_prior_case_

| 24-36 | 36-48 | 48-60 | 60-72 | 72-84 | 84-96 | 96-108 | 108-120 | 120-132 | |

|---|---|---|---|---|---|---|---|---|---|

| 1998 | 0.5378 | 0.5541 | 0.5253 | 0.4981 | 0.5329 | 0.5380 | 0.5877 | 0.6970 | 0.5798 |

| 1999 | 0.5368 | 0.5649 | 0.5442 | 0.4969 | 0.5029 | 0.5800 | 0.6420 | 0.6506 | |

| 2000 | 0.5461 | 0.5742 | 0.5391 | 0.4872 | 0.5376 | 0.5432 | 0.6655 | ||

| 2001 | 0.5406 | 0.5660 | 0.5148 | 0.5013 | 0.5077 | 0.5414 | |||

| 2002 | 0.5409 | 0.5546 | 0.5406 | 0.4802 | 0.4881 | ||||

| 2003 | 0.5265 | 0.5765 | 0.5363 | 0.4764 | |||||

| 2004 | 0.5298 | 0.5665 | 0.5069 | ||||||

| 2005 | 0.5215 | 0.5539 | |||||||

| 2006 | 0.5261 | ||||||||

| 2007 |

model.case_ldf_

| 24-36 | 36-48 | 48-60 | 60-72 | 72-84 | 84-96 | 96-108 | 108-120 | 120-132 | |

|---|---|---|---|---|---|---|---|---|---|

| (All) | 0.5340 | 0.5638 | 0.5296 | 0.4900 | 0.5139 | 0.5506 | 0.6317 | 0.6738 | 0.5798 |

TweedieGLM#

The TweedieGLM implements the GLM reserving structure discussed by Taylor and McGuire.

A nice property of the GLM framework is that it is highly flexible in terms of including

covariates that may be predictive of loss reserves while maintaining a close relationship

to traditional methods. Additionally, the framework can be extended in a straightforward

way to incorporate various approaches to measuring prediction errors. Behind the

scenes, TweedieGLM is using scikit-learn’s TweedieRegressor estimator.

Long Format#

GLMs are fit to triangles in “Long Format”. That is, they are converted to pandas

DataFrames behind the scenes. Each axis of the Triangle is included in the

dataframe. The origin and development axes are in columns of the same name.

You can inspect what your Triangle looks like in long format by calling to_frame

with keepdims=True

cl.load_sample('clrd').to_frame(keepdims=True).reset_index().head()

| GRNAME | LOB | origin | development | IncurLoss | CumPaidLoss | BulkLoss | EarnedPremDIR | EarnedPremCeded | EarnedPremNet | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0 | Adriatic Ins Co | othliab | 1995-01-01 | 12 | 8.0 | NaN | 8.0 | 139.0 | 131.0 | 8.0 |

| 1 | Adriatic Ins Co | othliab | 1995-01-01 | 24 | 11.0 | NaN | 4.0 | 139.0 | 131.0 | 8.0 |

| 2 | Adriatic Ins Co | othliab | 1995-01-01 | 36 | 7.0 | 3.0 | 4.0 | 139.0 | 131.0 | 8.0 |

| 3 | Adriatic Ins Co | othliab | 1996-01-01 | 12 | 40.0 | NaN | 40.0 | 410.0 | 359.0 | 51.0 |

| 4 | Adriatic Ins Co | othliab | 1996-01-01 | 24 | 40.0 | NaN | 40.0 | 410.0 | 359.0 | 51.0 |

Warning

‘origin’, ‘development’, and ‘valuation’ are reserved keywords for the dataframe. Declaring columns with these names separately will result in error.

While you can inspect the Triangle in long format, you will not directly convert

to long format yourself. The TweedieGLM does this for you. Additionally,

the origin of the design matrix is restated in years from the earliest origin

period. That is, is if the earliest origin is ‘1995-01-01’ then it gets replaced with

0. Consequently, ‘1996-04-01’ would be replaced with 1.25. This is done because

datetimes have limited support in scikit-learn. Finally, the TweedieGLM

will automatically convert the response to an incremental basis.

R-style formulas#

We use the patsy library to allow formulation of the the feature set X

of the GLM. Because X is a parameter that used extensively throughout

chainladder, the TweedieGLM refers to it as the design_matrix. Those

familiar with the R programming language will be familiar with the notation

used by patsy. For example, we can include both origin and development

as terms in a model.

genins = cl.load_sample('genins')

glm = cl.TweedieGLM(design_matrix='development + origin').fit(genins)

glm.coef_

| coef_ | |

|---|---|

| Intercept | 13.516322 |

| development | -0.006251 |

| origin | 0.033863 |

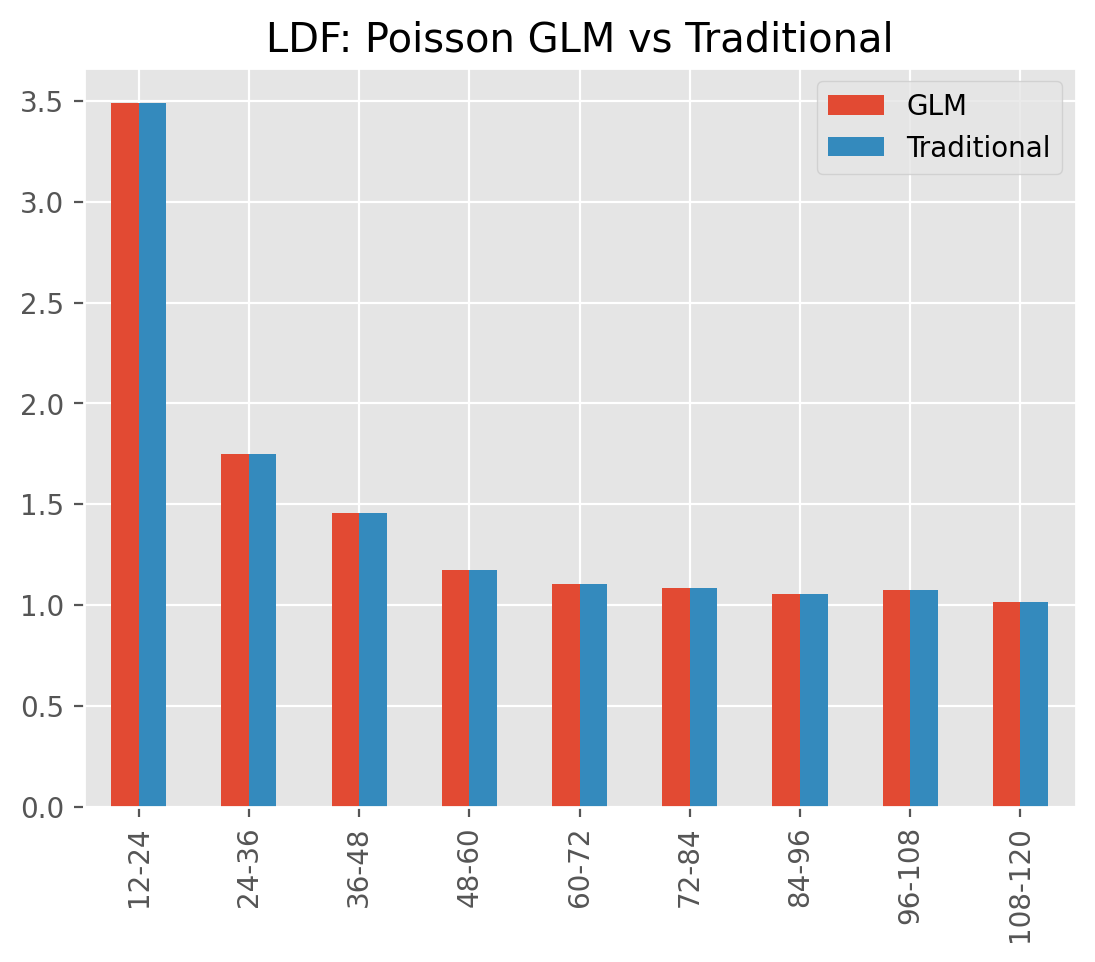

ODP Chainladder#

Replicating the results of the volume weighted chainladder development patterns

can be done by fitting a Poisson-log GLM to incremental paids. To do this, we

can specify the power and link of the estimator as well as the design_matrix.

The volume-weighted chainladder method can be replicated by including both

origin and development as categorical features.

dev = cl.TweedieGLM(

design_matrix='C(development) + C(origin)',

power=1, link='log').fit(genins)

A trivial comparison against the traditional Development estimator shows

a comparable set of ldf_ patterns.

Parsimonious modeling#

Having full access to all axes of the Triangle along with the powerful formulation

of patsy allows for substantial customization of the model fit. For example,

we can include ‘LOB’ interactions with piecewise linear coefficients to reduce

model complexity.

clrd = cl.load_sample('clrd')['CumPaidLoss'].groupby('LOB').sum()

clrd=clrd[clrd['LOB'].isin(['ppauto', 'comauto'])]

dev = cl.TweedieGLM(

design_matrix='LOB+LOB:C(np.minimum(development, 36))+LOB:development+LOB:origin',

max_iter=1000).fit(clrd)

dev.coef_

| coef_ | |

|---|---|

| Intercept | 12.550094 |

| LOB[T.ppauto] | 3.202525 |

| LOB[comauto]:C(np.minimum(development, 36))[T.24] | 0.578636 |

| LOB[ppauto]:C(np.minimum(development, 36))[T.24] | 0.449818 |

| LOB[comauto]:C(np.minimum(development, 36))[T.36] | 0.790583 |

| LOB[ppauto]:C(np.minimum(development, 36))[T.36] | 0.321155 |

| LOB[comauto]:development | -0.044631 |

| LOB[ppauto]:development | -0.054813 |

| LOB[comauto]:origin | 0.054570 |

| LOB[ppauto]:origin | 0.057791 |

This model is limited to 10 coefficients across two lines of business. The basic

chainladder model is known to be overparameterized with at least 18 parameters

requiring estimation. Despite drastically simplifying the model, the cdf_

patterns of the GLM are within 1% of the traditional chainladder for every lag

and for both lines of business:

((dev.cdf_.iloc[..., 0, :] /

cl.Development().fit(clrd).cdf_) - 1

).to_frame().round(3)

| development | 12-Ult | 24-Ult | 36-Ult | 48-Ult | 60-Ult | 72-Ult | 84-Ult | 96-Ult | 108-Ult |

|---|---|---|---|---|---|---|---|---|---|

| LOB | |||||||||

| comauto | 0.002 | 0.003 | -0.01 | 0.003 | 0.011 | 0.008 | 0.005 | -0.000 | -0.002 |

| ppauto | 0.006 | 0.003 | -0.00 | 0.001 | 0.002 | 0.001 | 0.001 | 0.001 | 0.001 |

Like every other Development estimator, the TweedieGLM produces a set of ldf_

patterns and can be used in a larger workflow with tail extrapolation and reserve

estimation.

DevelopmentML#

DevelopmentML is a general development estimator that works as an interface to

scikit-learn compliant machine learning (ML) estimators. The TweedieGLM is

a special case of DevelopmentML with the ML algorithm limited to scikit-learn’s

TweedieRegressor estimator.

The Interface#

ML algorithms are designed to be fit against tabular data like a pandas DataFrame

or a 2D numpy array. A Triangle does not meet the definition and so DevelopmentML

is provided to incorporate ML into a broader reserving workflow. This includes:

Automatic conversion of Triangle to a dataframe for fitting

Flexibility in expressing any preprocessing as part of a scikit-learn

PipelinePredictions through the terminal development age of a

Triangleto fill in the lower halfPredictions converted to

ldf_patterns so that the results of the estimator are compliant with the rest ofchainladder, like tail selection and IBNR modeling.

Features#

Data from any axis of a Triangle is available to be used in the DevelopmentML

estimator. For example, we can use many of the scikit-learn components to

generate development patterns from both the time axes as well as the index of

the Triangle.

from sklearn.ensemble import RandomForestRegressor

from sklearn.pipeline import Pipeline

from sklearn.preprocessing import OneHotEncoder

from sklearn.compose import ColumnTransformer

clrd = cl.load_sample('clrd').groupby('LOB').sum()['CumPaidLoss']

# Decide how to preprocess the X (ML) dataset using sklearn

design_matrix = ColumnTransformer(transformers=[

('dummy', OneHotEncoder(drop='first'), ['LOB', 'development']),

('passthrough', 'passthrough', ['origin'])

])

# Wrap preprocessing and model in a larger sklearn Pipeline

estimator_ml = Pipeline(steps=[

('design_matrix', design_matrix),

('model', RandomForestRegressor())

])

# Fitting DevelopmentML fits the underlying ML model and gives access to ldf_

cl.DevelopmentML(estimator_ml=estimator_ml, y_ml='CumPaidLoss').fit(clrd).ldf_

| Triangle Summary | |

|---|---|

| Valuation: | 2261-12 |

| Grain: | OYDY |

| Shape: | (6, 1, 10, 9) |

| Index: | [LOB] |

| Columns: | [CumPaidLoss] |

Autoregressive#

The time-series nature of loss development naturally lends to an urge for autoregressive

features. That is, features that are based on predictions, albeit on a lagged basis.

DevelopmentML includes an autoregressive parameter that can be used to

express the response as a lagged feature as well.

Note

When using autoregressive features, you must also declare it as a column

in your estimator_ml Pipeline.

PatsyFormula#

While the sklearn preprocessing API is powerful, it can be tedious work with in

some instances. In particular, modeling complex interactions is much easier to do

with Patsy. The chainladder package includes a custom sklearn estimator

to gain access to the patsy API. This is done through the PatsyFormula estimator.

estimator_ml = Pipeline(steps=[

('design_matrix', cl.PatsyFormula('LOB:C(origin)+LOB:C(development)+development')),

('model', RandomForestRegressor())

])

cl.DevelopmentML(

estimator_ml=estimator_ml,

y_ml='CumPaidLoss').fit(clrd).ldf_.iloc[0, 0, 0].round(2)

| 12-24 | 24-36 | 36-48 | 48-60 | 60-72 | 72-84 | 84-96 | 96-108 | 108-120 | |

|---|---|---|---|---|---|---|---|---|---|

| (All) | 2.6100 | 1.4100 | 1.1900 | 1.1000 | 1.0400 | 1.0200 | 1.0100 | 1.0100 | 1.0100 |

Note

PatsyFormula is not an estimator designed to work with triangles. It is an sklearn transformer designed to work with pandas DataFrames allowing it to work directly in an sklearn Pipeline.

BarnettZehnwirth#

The BarnettZehnwirth estimator solves for development patterns using the

Probabilistic Trend Family (PTF) regression framework. Unlike the ELRF framework,

which assumes no valuation covariate, the PTF framework allows for this.

Structurally, the PTF regression is different from the ELRF (ELRF) regression framework in

two distinct ways:

Where the ELRF fits independent regressions to each adjacent development lag, the PTF regression is fit to the entire triangle

Where the ELRF is fit to cumulative amounts, the PTF is fit to the log of the incremental amounts of the

Triangle.

Formulation#

The PTF framework is an ordinary least squares (OLS) model with the response, y

being the log of the incremental amounts of a Triangle. These are assumed to be

normally distributed which implies the incrementals themselves are log-normal

distributed.

The framework includes coefficients for origin periods (alpha), development periods (gamma) and calendar period (iota).

$y(i, j) = \alpha {i} + \sum{k=1}^{j}\gamma {k}+ \sum{\iota =1}^{i+j}\gamma _{\iota}+ \varepsilon _{i,j}$

These coefficients can be categorical or continuous, and to support a wide range of model forms, patsy formulas are used.

abc = cl.load_sample('abc')

# Discrete origin, development, valuation

cl.BarnettZehnwirth(formula='C(origin)+C(development)').fit(abc).coef_.T

| Intercept | C(origin)[T.1.0] | C(origin)[T.2.0] | C(origin)[T.3.0] | C(origin)[T.4.0] | C(origin)[T.5.0] | C(origin)[T.6.0] | C(origin)[T.7.0] | C(origin)[T.8.0] | C(origin)[T.9.0] | ... | C(development)[T.24] | C(development)[T.36] | C(development)[T.48] | C(development)[T.60] | C(development)[T.72] | C(development)[T.84] | C(development)[T.96] | C(development)[T.108] | C(development)[T.120] | C(development)[T.132] | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| coef_ | 11.836863 | 0.178824 | 0.345112 | 0.378133 | 0.405093 | 0.427041 | 0.431076 | 0.660383 | 0.963223 | 1.1568 | ... | 0.251091 | -0.055824 | -0.448589 | -0.828917 | -1.16913 | -1.507561 | -1.798345 | -2.0231 | -2.238333 | -2.427672 |

1 rows × 21 columns

# Linear coefficients for origin, development, and valuation

cl.BarnettZehnwirth(formula='origin+development+valuation').fit(abc).coef_.T

| Intercept | origin | development | valuation | |

|---|---|---|---|---|

| coef_ | 8.359157 | 4.215981 | 0.319288 | -4.116569 |

The PTF framework is particularly useful when there is calendar period inflation influences on loss development.