Value at Risk#

import chainladder as cl

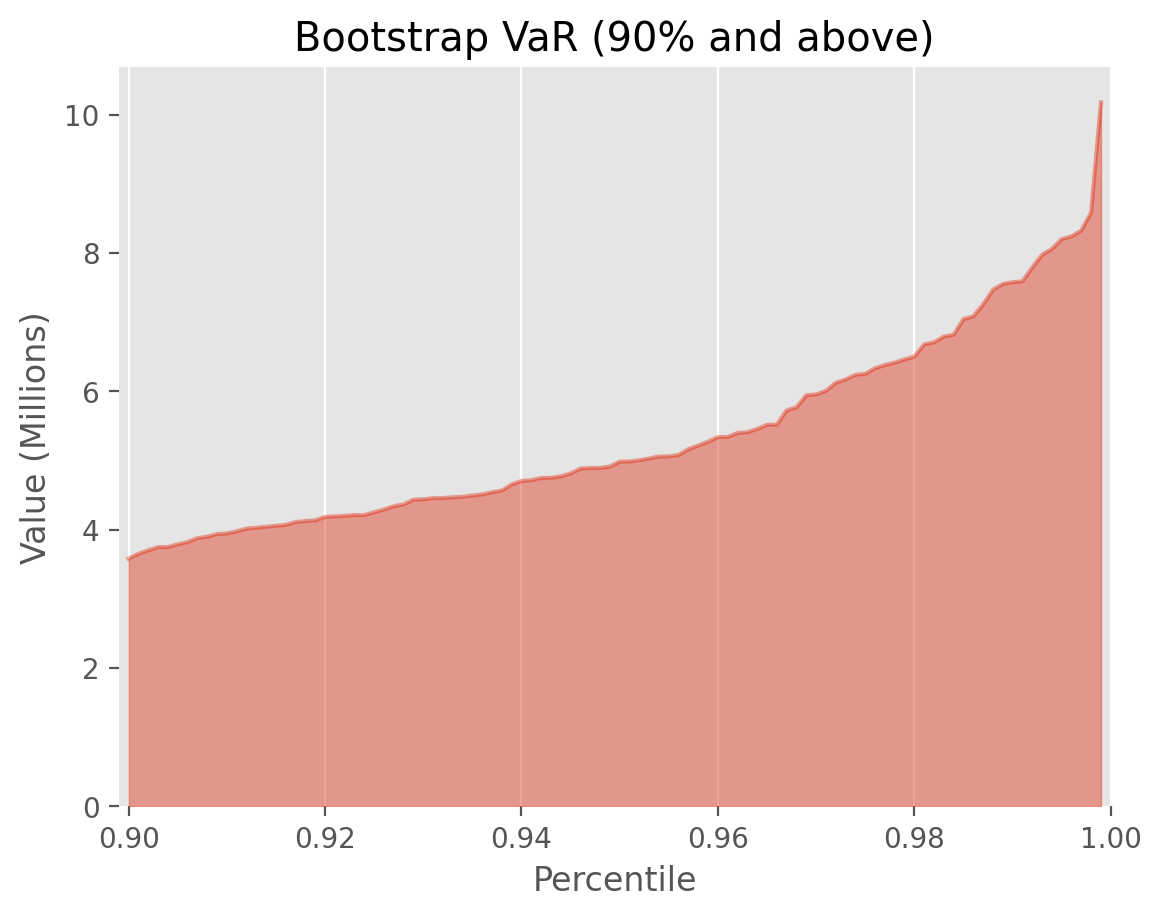

This example uses the BootstrapODPSample to simulate new triangles that

are then used to simulate an IBNR distribution from which we can do

Value at Risk percentile lookups.

# Load triangle

triangle = cl.load_sample('genins')

# Create 1000 bootstrap samples of the triangle

resampled_triangles = cl.BootstrapODPSample(random_state=42).fit_transform(triangle)

# Create 1000 IBNR estimates

sim_ibnr = cl.Chainladder().fit(resampled_triangles).ibnr_.sum('origin')

# X - mu

sim_ibnr = (sim_ibnr - sim_ibnr.mean()).to_frame().sort_values()

Show code cell source

import matplotlib.pyplot as plt

plt.style.use('ggplot')

%config InlineBackend.figure_format = 'retina'

# Plot data

fig, ax = plt.subplots()

sim_ibnr.index = [item/1000 for item in range(1000)]

(sim_ibnr/1e6).loc[0.90:].plot(kind='area', alpha=0.5,

title='Bootstrap VaR (90% and above)', ax=ax).set(

xlabel='Percentile', xlim=(0.899, 1.0), ylabel='Value (Millions)');

ax.grid(axis='y')

for spine in ax.spines:

ax.spines[spine].set_visible(False)